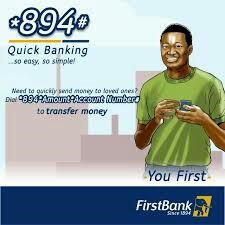

[NIGERIA] :FirstBank processes over N1tr on ‘894’ quick banking channel

First Bank of Nigeria Limited has recorded giant strides in its

Financial Inclusion services delivery, via its 894 quick banking, a USSD

based channel that enables customers to access banking services using

any type of phone and without data/internet.

The 894 banking scheme, which is the fastest growing USSD scheme in the market, grew by about 250% in 2017 to now over 4.5million customers with a target base of over 6.5million before the end of this year. Over N1 trillion worth of transactions have been processed using the 894 services, with over N3 trillion worth of transactions projected to be processed this year alone.

Customers who use 894 are able to check their balance, send/transfer money to any bank account in Nigeria, buy airtime for themselves and for their loved ones, confirm payments (up to last 5 transactions), open accounts, and do lots more.

The “894 Collection & CashOut” service is effectively designed for businesses to receive payments for goods and services, and to address their cash management challenges. It is also a very viable channel for government to collect taxes and other statutory payments.

According to FirstBank’s Group Head, e-business, Chuma Ezirim, a major element of the Bank’s strategy is to make payments and collections easier for businesses around the country.

Digitizing payment and collections processes not only improves transparency and efficiency, but also helps a business to grow. “That’s why our 894 service is very useful for our Corporate and SME customers because every Nigerian can pay using 894 irrespective of the type of phone he/she uses, and without the barrier of internet access”, he enthused.

Speaking on the impact of the Bank’s Financial Inclusion services on customers and the economy, Mr. Ezirim said that in addition to providing FirstBank customers a more convenient and faster way to carry out basic banking transactions, the 894 banking service has led to the creation of over 500 new jobs for young Nigerians who assist customers to adopt digital platforms at the various branches of the Bank nationwide.

The 894 service is simple, secure, and easy to use, which is why the adoption rate by customers is very high. The channel is enabling the Bank to provide more efficient banking services to its customers, and offers a cost effective growth of the Bank’s retail and commercial banking businesses.

Over 60% of FirstBank’s customers currently use the Bank’s digital platforms (FirstMobile, Firstonline and 894 Banking) to transact and this accounts for about 21% of transactions on the NIBSS Instant Payment platform.

The 894 banking scheme, which is the fastest growing USSD scheme in the market, grew by about 250% in 2017 to now over 4.5million customers with a target base of over 6.5million before the end of this year. Over N1 trillion worth of transactions have been processed using the 894 services, with over N3 trillion worth of transactions projected to be processed this year alone.

Customers who use 894 are able to check their balance, send/transfer money to any bank account in Nigeria, buy airtime for themselves and for their loved ones, confirm payments (up to last 5 transactions), open accounts, and do lots more.

The “894 Collection & CashOut” service is effectively designed for businesses to receive payments for goods and services, and to address their cash management challenges. It is also a very viable channel for government to collect taxes and other statutory payments.

According to FirstBank’s Group Head, e-business, Chuma Ezirim, a major element of the Bank’s strategy is to make payments and collections easier for businesses around the country.

Digitizing payment and collections processes not only improves transparency and efficiency, but also helps a business to grow. “That’s why our 894 service is very useful for our Corporate and SME customers because every Nigerian can pay using 894 irrespective of the type of phone he/she uses, and without the barrier of internet access”, he enthused.

Speaking on the impact of the Bank’s Financial Inclusion services on customers and the economy, Mr. Ezirim said that in addition to providing FirstBank customers a more convenient and faster way to carry out basic banking transactions, the 894 banking service has led to the creation of over 500 new jobs for young Nigerians who assist customers to adopt digital platforms at the various branches of the Bank nationwide.

The 894 service is simple, secure, and easy to use, which is why the adoption rate by customers is very high. The channel is enabling the Bank to provide more efficient banking services to its customers, and offers a cost effective growth of the Bank’s retail and commercial banking businesses.

Over 60% of FirstBank’s customers currently use the Bank’s digital platforms (FirstMobile, Firstonline and 894 Banking) to transact and this accounts for about 21% of transactions on the NIBSS Instant Payment platform.

![[NIGERIA] : China Development Bank, UBA Sign Letter of Intent for a $100 million Loan Deal to Support SMEs in Africa](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgTdQcYfF2h0OCH0BzpeyGMRfxGK-i1xr0Dcaw_eq_oa9Oi4tGf8EgDwNstvQja-_FbrLvvYP-HtcB8MKWBNolDmftPMpB-aLNYzt97ey79X-n7I_7FUCsiTQxn99fiJB4SmyW8s-p9c33U/s72-c/uba+1.jpg)

No comments